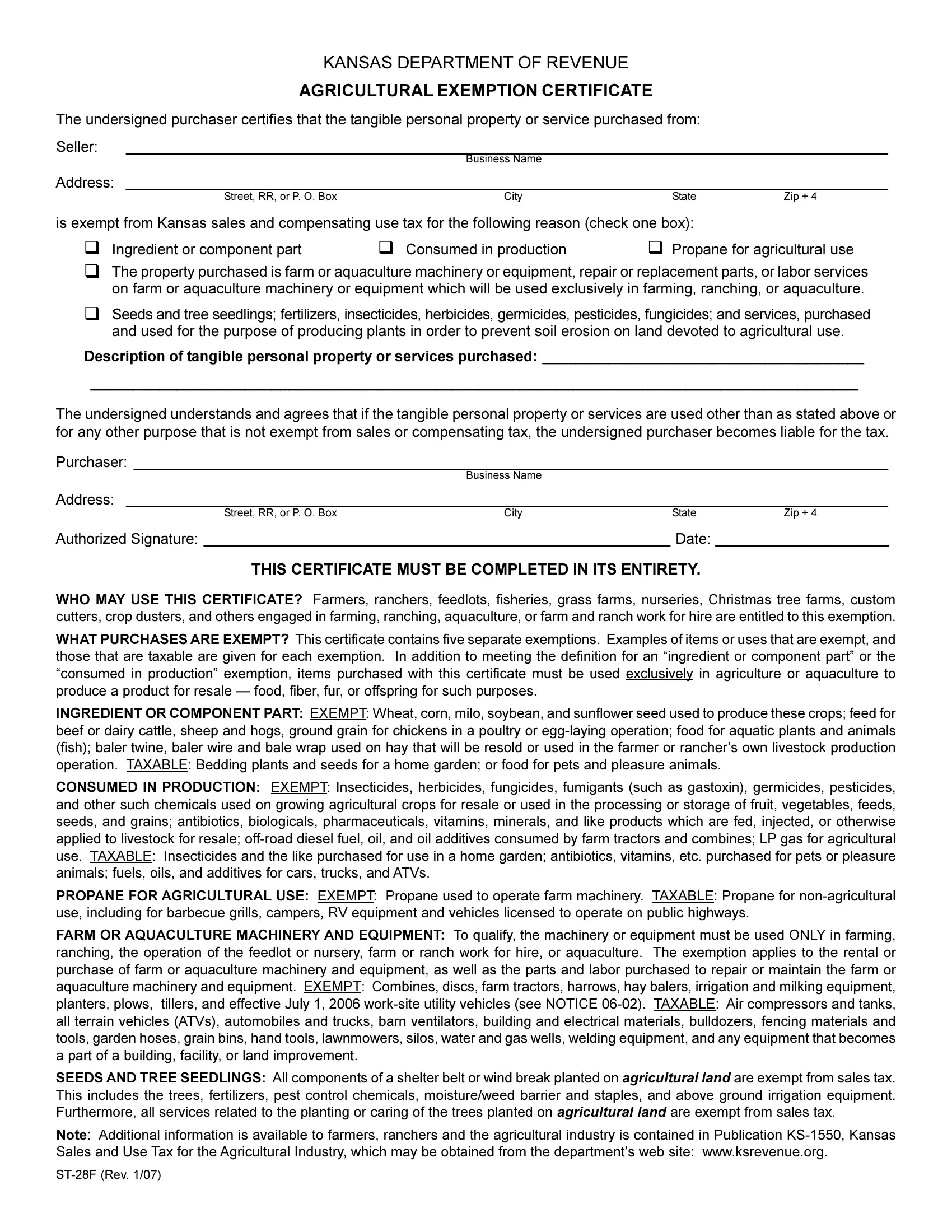

kansas sales tax exemption form pdf

You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases.

Form St 28f Fill Out Printable Pdf Forms Online

This was a unique ruling handed down during a unique time in US history that denied a corporation freedom it sought in the courtroom.

. States collect a state income tax. Then you are required to register for a regular Kansas sales tax permit. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases.

You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. Sales Use Tax Exemption Form G-17 or G-18 or G-19 or Uniform Sales Use Tax Exemption Form G-17 or G-18 or G-19 or Uniform Sales Use Tax Exemption Form. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases.

How to use sales tax exemption certificates in Alabama. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. Form 1023 is used to apply for recognition as a tax exempt organization. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases.

Out-of-state vendors participating in a single event may remit sales tax using Form IDOR-6-SETR Special Event Tax Collection Report and Payment Coupon. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. How to use sales tax exemption certificates in Mississippi.

COVID-19 Retail Storefront Property Tax Relief Act. How to use sales tax exemption certificates in Wyoming. KANSAS DEPARTMENT OF REVENUE ONLINE SERVICES.

How to use sales tax exemption certificates in Connecticut. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to.

How to use sales tax exemption certificates in Maryland. Many of our services are conveniently available online. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to.

For purchases 1000 provide vendor with Utah Sales Tax Exemption Contract TC-73 PDF Form expires 7202019 For purchases over 1000 provide vendor with Utah Exemption Certificate TC-721 PDF ReligiousCharitable Sales Tax Exemption Number N20796. Some local governments also impose an income tax often based on state income tax calculations. How to use sales tax exemption certificates in Oklahoma.

In addition to federal income tax collected by the United States most individual US. Or Designated or Generic Exemption Certificate ST-28 Tax Exempt Entity Name. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to.

How to use sales tax exemption certificates in Illinois. Exemption from state sales tax applies to hotel occupancy. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. Read more at the Arkansas DFAs Special Event Promoters Sales Tax Information document opens in PDF. Lee the court ruled that there could be a corporate tax essentially saying the structure of business was a justifiably discriminatory criterion for governments to consider when writing tax legislation.

Forty-two states and many localities in the United States impose an income tax on individuals. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. These resources include best practices sample documents GFOA products and services and links to web data sources and to related organizations.

How to use sales tax exemption certificates in Louisiana. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. House Bill 2136 enacted during the 2022 Legislative Session created the COVID-19 Retail Storefront Property Tax Relief Act the purpose.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. How to use sales tax exemption certificates in California.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to.

How to use sales tax exemption certificates in New Jersey. How to use sales tax exemption certificates in Kentucky. The GFOA Materials Library provides current information in various topical areas.

Eight states impose no state income tax and a ninth New. Kansas Form ST-28 or Form ST-28G or Streamlined Sales Tax Agreement Certificate of Exemption Form ST-28 or Form PR-78KS or Form PR-78ED or Streamlined. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to make a tax.

How to use sales tax exemption certificates in New York. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. How to use sales tax exemption certificates in Ohio.

You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. Information about Form 1023 Application for Recognition of Exemption Under Section 501c3 of the Internal Revenue Code including recent updates related forms and instructions on how to file. OState Exemption from Kansas Sales Tax Tax exempt entity shall present the Kansas Department of Revenue-issued tax-exempt entity sales tax exemption certificate showing state-issued exempt organization ID number.

In many cases you can skip a trip to our offices. How to use sales tax exemption certificates in Kansas. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases.

How to use sales tax exemption certificates in Georgia. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to make a. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to.

You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. How to use sales tax exemption certificates in Virginia. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases.

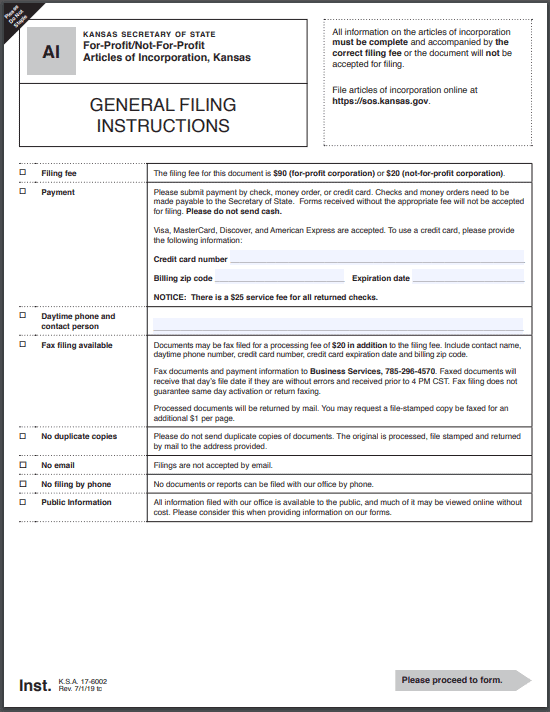

Start A Nonprofit In Kansas Fast Online Filings

Ks Exemption Fill Out Sign Online Dochub

Form Pec Entities Fillable Sales And Use Tax Refund Application For Use By Project Exemption Certificate

Fillable Online Baldwincity Kansas Department Of Revenue Baldwincityorg Fax Email Print Pdffiller

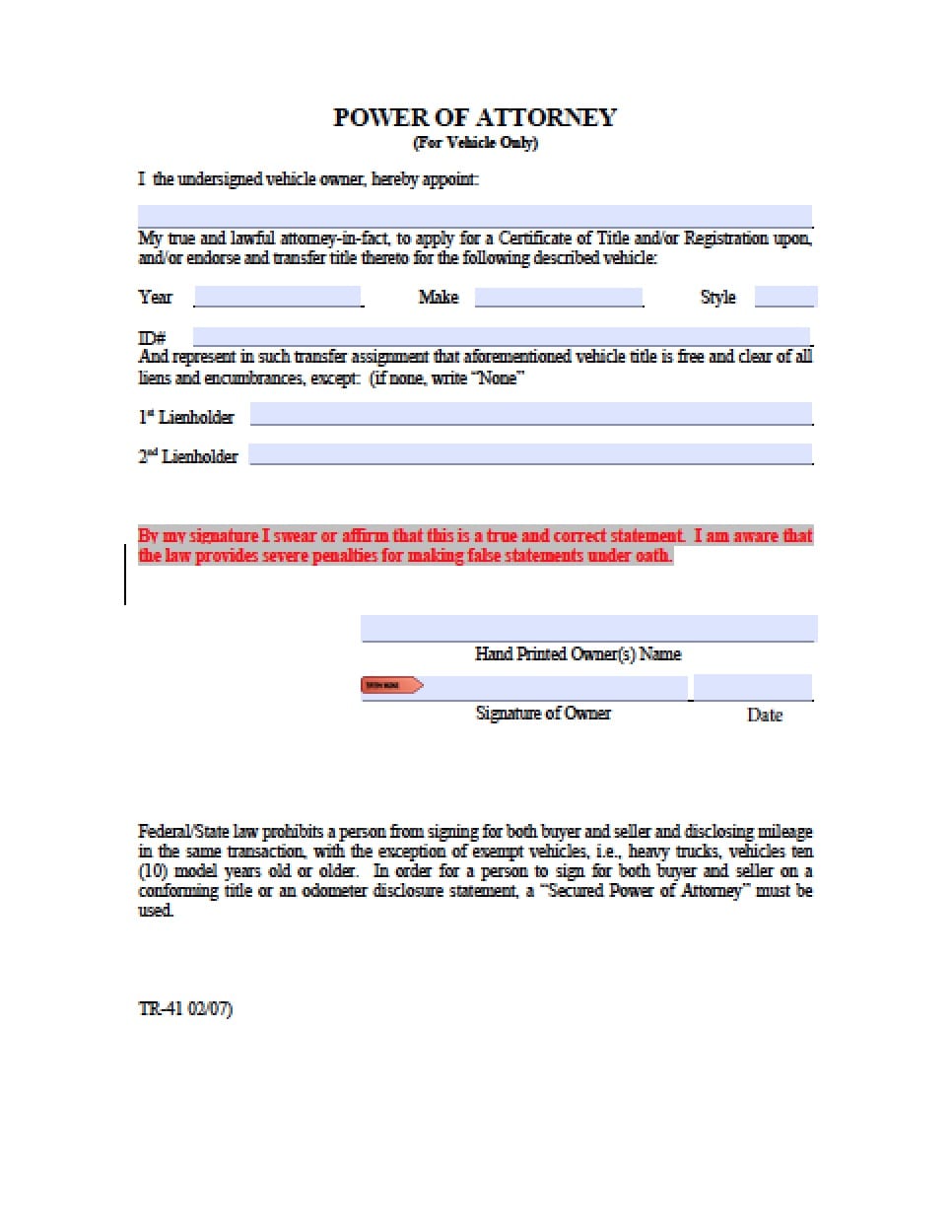

Kansas Vehicle Donation Title Information

Kansas Vehicle Power Of Attorney Form Power Of Attorney Power Of Attorney

Kansas Quitclaim Deed Form Legal Templates

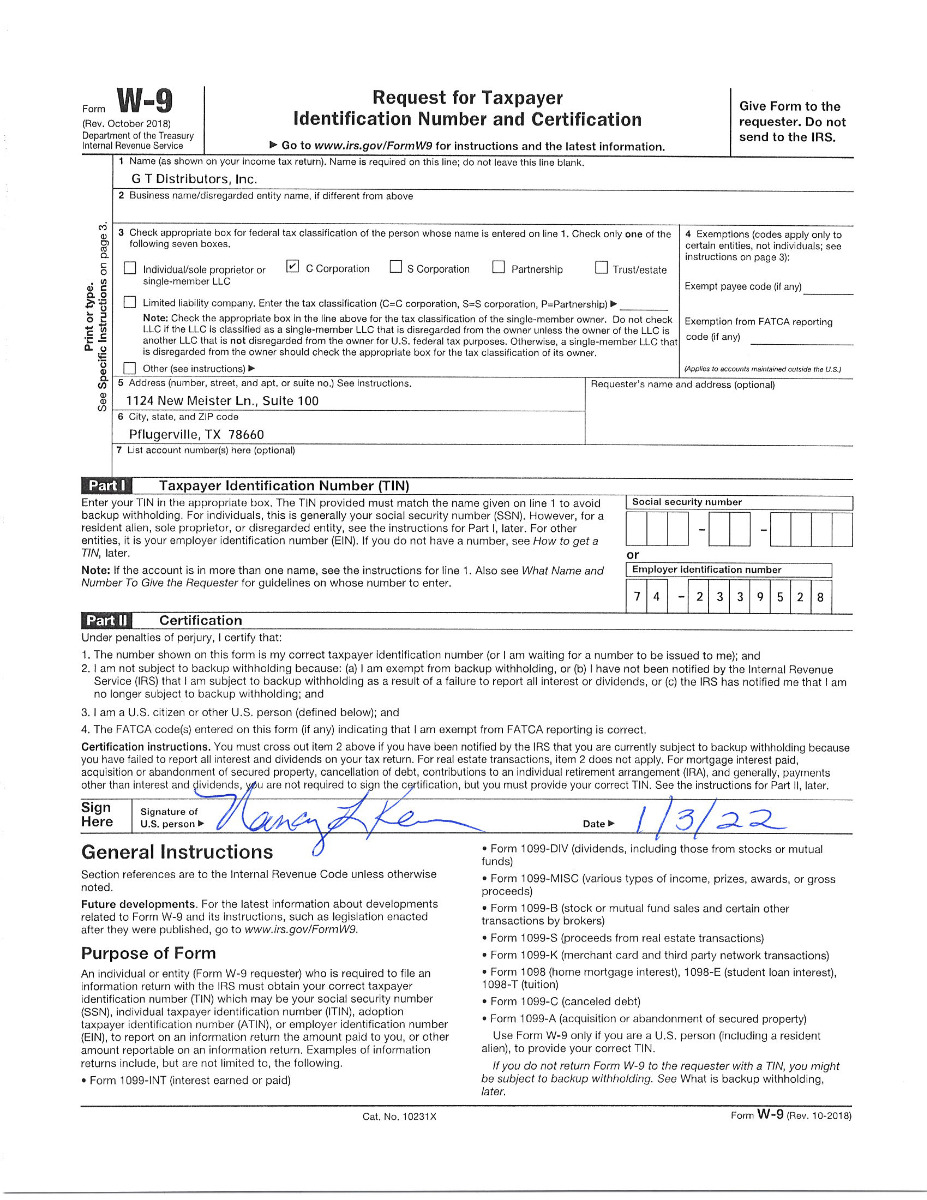

Forms Tactical Gear And Police Equipment From Gt Distributors

Application For Hospital Sales Tax Exemption Stax 300 H Pdf Fpdf Doc Docx

Sales Taxes In The United States Wikipedia

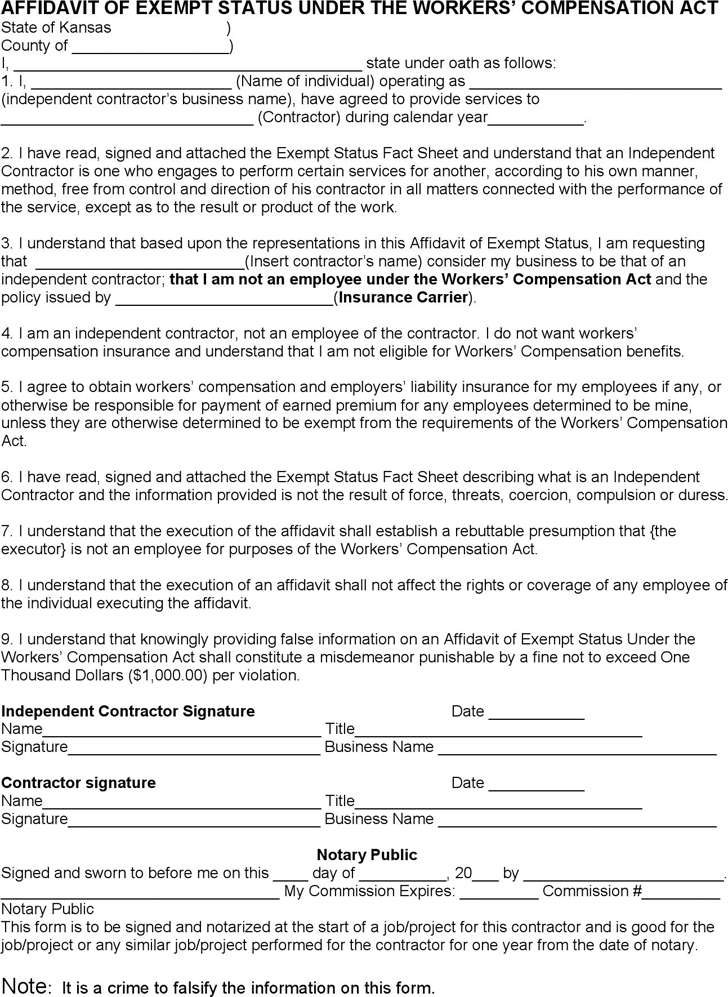

Free Kansas Affidavit Of Exempt Status Under The Workers Compensation Act Form Pdf 19kb 2 Page S

Free Kansas Bill Of Sale Form Templates

Business Form Finder All Forms On File For Department Of Revenue